UBS Luxembourg Enhances Crossborder Remittance Safety Efficiency

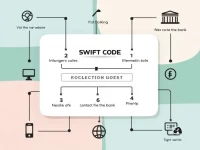

This article introduces the SWIFT code UBSWLULLFSL for UBS EUROPE SE, LUXEMBOURG BRANCH, and discusses the security and accuracy of cross-border remittances. Understanding the use of SWIFT codes and bank information is essential for the correct transfer of funds, especially when dealing with multiple branches.